Can You Write Off Uniforms On Taxes . Web work clothes are a miscellaneous tax deduction. Web clothing is one of the more contested tax deductions, and it tends to get rejected a lot. Web eligible pieces of clothing can be claimed alongside your other deductible expenses, on schedule c of your tax. Web work clothes are tax deductible if your employer requires you to wear them everyday but they cannot be worn as. The option to write them off as a miscellaneous deduction, subject to a 2% of adjusted gross income threshold, was discontinued in 2018 through the tax cuts and jobs act of 2017 (tcja). Web the irs only allows you to deduct the cost of work clothing and uniforms if you satisfy a number of.

from blog.turbotax.intuit.com

Web the irs only allows you to deduct the cost of work clothing and uniforms if you satisfy a number of. Web work clothes are a miscellaneous tax deduction. Web clothing is one of the more contested tax deductions, and it tends to get rejected a lot. Web work clothes are tax deductible if your employer requires you to wear them everyday but they cannot be worn as. Web eligible pieces of clothing can be claimed alongside your other deductible expenses, on schedule c of your tax. The option to write them off as a miscellaneous deduction, subject to a 2% of adjusted gross income threshold, was discontinued in 2018 through the tax cuts and jobs act of 2017 (tcja).

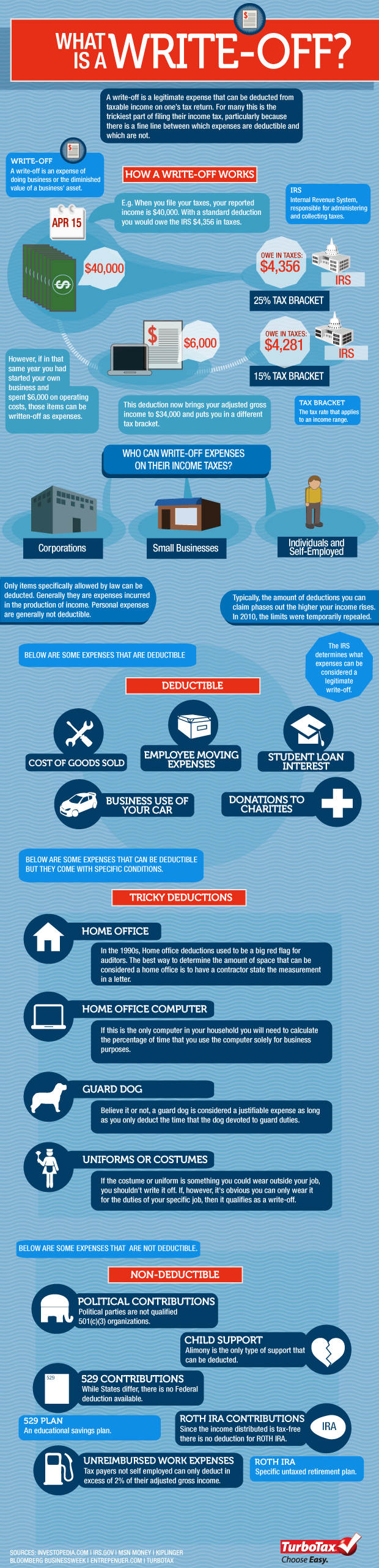

What is a Tax WriteOff? The TurboTax Blog

Can You Write Off Uniforms On Taxes Web work clothes are tax deductible if your employer requires you to wear them everyday but they cannot be worn as. Web clothing is one of the more contested tax deductions, and it tends to get rejected a lot. Web work clothes are tax deductible if your employer requires you to wear them everyday but they cannot be worn as. Web the irs only allows you to deduct the cost of work clothing and uniforms if you satisfy a number of. The option to write them off as a miscellaneous deduction, subject to a 2% of adjusted gross income threshold, was discontinued in 2018 through the tax cuts and jobs act of 2017 (tcja). Web eligible pieces of clothing can be claimed alongside your other deductible expenses, on schedule c of your tax. Web work clothes are a miscellaneous tax deduction.

From www.alliedhomesecurity.net

Can you write off your security or alarm system on your taxes? Can You Write Off Uniforms On Taxes Web work clothes are tax deductible if your employer requires you to wear them everyday but they cannot be worn as. Web the irs only allows you to deduct the cost of work clothing and uniforms if you satisfy a number of. Web clothing is one of the more contested tax deductions, and it tends to get rejected a lot.. Can You Write Off Uniforms On Taxes.

From www.mortgagerater.com

What Can You Write Off On Taxes Ultimate Guide Can You Write Off Uniforms On Taxes Web work clothes are a miscellaneous tax deduction. Web work clothes are tax deductible if your employer requires you to wear them everyday but they cannot be worn as. Web the irs only allows you to deduct the cost of work clothing and uniforms if you satisfy a number of. The option to write them off as a miscellaneous deduction,. Can You Write Off Uniforms On Taxes.

From www.tffn.net

Can You Write Off Home Health Care on Taxes? Exploring the Tax Benefits Can You Write Off Uniforms On Taxes Web the irs only allows you to deduct the cost of work clothing and uniforms if you satisfy a number of. The option to write them off as a miscellaneous deduction, subject to a 2% of adjusted gross income threshold, was discontinued in 2018 through the tax cuts and jobs act of 2017 (tcja). Web work clothes are tax deductible. Can You Write Off Uniforms On Taxes.

From cexrzvzm.blob.core.windows.net

Can You Write Off Property Taxes On A Second Home at Joseph Allen blog Can You Write Off Uniforms On Taxes Web the irs only allows you to deduct the cost of work clothing and uniforms if you satisfy a number of. Web clothing is one of the more contested tax deductions, and it tends to get rejected a lot. The option to write them off as a miscellaneous deduction, subject to a 2% of adjusted gross income threshold, was discontinued. Can You Write Off Uniforms On Taxes.

From www.linkedin.com

What Expenses Can You Write Off On Your Taxes? Can You Write Off Uniforms On Taxes Web work clothes are tax deductible if your employer requires you to wear them everyday but they cannot be worn as. Web eligible pieces of clothing can be claimed alongside your other deductible expenses, on schedule c of your tax. Web the irs only allows you to deduct the cost of work clothing and uniforms if you satisfy a number. Can You Write Off Uniforms On Taxes.

From fabalabse.com

What can truckers write off on their taxes? Leia aqui How much of a Can You Write Off Uniforms On Taxes Web work clothes are tax deductible if your employer requires you to wear them everyday but they cannot be worn as. The option to write them off as a miscellaneous deduction, subject to a 2% of adjusted gross income threshold, was discontinued in 2018 through the tax cuts and jobs act of 2017 (tcja). Web eligible pieces of clothing can. Can You Write Off Uniforms On Taxes.

From factsontaxes.com

Can You Write Off Gambling Losses In Canada? Can You Write Off Uniforms On Taxes Web the irs only allows you to deduct the cost of work clothing and uniforms if you satisfy a number of. Web eligible pieces of clothing can be claimed alongside your other deductible expenses, on schedule c of your tax. The option to write them off as a miscellaneous deduction, subject to a 2% of adjusted gross income threshold, was. Can You Write Off Uniforms On Taxes.

From edenwes.weebly.com

Business tax write offs 2018 edenwes Can You Write Off Uniforms On Taxes Web work clothes are tax deductible if your employer requires you to wear them everyday but they cannot be worn as. Web the irs only allows you to deduct the cost of work clothing and uniforms if you satisfy a number of. The option to write them off as a miscellaneous deduction, subject to a 2% of adjusted gross income. Can You Write Off Uniforms On Taxes.

From merriellewnerta.pages.dev

What Can You Write Off On Taxes 2024 Eddie Lezlie Can You Write Off Uniforms On Taxes The option to write them off as a miscellaneous deduction, subject to a 2% of adjusted gross income threshold, was discontinued in 2018 through the tax cuts and jobs act of 2017 (tcja). Web work clothes are tax deductible if your employer requires you to wear them everyday but they cannot be worn as. Web clothing is one of the. Can You Write Off Uniforms On Taxes.

From renewcleanup.com

Can You Write Off House Cleaning Services on Your Taxes? Can You Write Off Uniforms On Taxes Web work clothes are tax deductible if your employer requires you to wear them everyday but they cannot be worn as. Web clothing is one of the more contested tax deductions, and it tends to get rejected a lot. Web eligible pieces of clothing can be claimed alongside your other deductible expenses, on schedule c of your tax. The option. Can You Write Off Uniforms On Taxes.

From fabalabse.com

What can truckers write off on their taxes? Leia aqui How much of a Can You Write Off Uniforms On Taxes The option to write them off as a miscellaneous deduction, subject to a 2% of adjusted gross income threshold, was discontinued in 2018 through the tax cuts and jobs act of 2017 (tcja). Web clothing is one of the more contested tax deductions, and it tends to get rejected a lot. Web work clothes are a miscellaneous tax deduction. Web. Can You Write Off Uniforms On Taxes.

From www.pinterest.com

Can you write off PCS expenses on your taxes? Yes to some of them! Can You Write Off Uniforms On Taxes Web clothing is one of the more contested tax deductions, and it tends to get rejected a lot. Web the irs only allows you to deduct the cost of work clothing and uniforms if you satisfy a number of. Web work clothes are a miscellaneous tax deduction. Web eligible pieces of clothing can be claimed alongside your other deductible expenses,. Can You Write Off Uniforms On Taxes.

From www.cleveland19.com

Top tax writeoffs that could get you in trouble with the IRS Can You Write Off Uniforms On Taxes Web work clothes are tax deductible if your employer requires you to wear them everyday but they cannot be worn as. Web the irs only allows you to deduct the cost of work clothing and uniforms if you satisfy a number of. Web eligible pieces of clothing can be claimed alongside your other deductible expenses, on schedule c of your. Can You Write Off Uniforms On Taxes.

From www.youtube.com

Can you write off property taxes Canada? YouTube Can You Write Off Uniforms On Taxes Web eligible pieces of clothing can be claimed alongside your other deductible expenses, on schedule c of your tax. Web work clothes are tax deductible if your employer requires you to wear them everyday but they cannot be worn as. Web work clothes are a miscellaneous tax deduction. Web the irs only allows you to deduct the cost of work. Can You Write Off Uniforms On Taxes.

From fabalabse.com

What personal expenses can I write off? Leia aqui How much of your Can You Write Off Uniforms On Taxes The option to write them off as a miscellaneous deduction, subject to a 2% of adjusted gross income threshold, was discontinued in 2018 through the tax cuts and jobs act of 2017 (tcja). Web eligible pieces of clothing can be claimed alongside your other deductible expenses, on schedule c of your tax. Web work clothes are tax deductible if your. Can You Write Off Uniforms On Taxes.

From www.youtube.com

Can you write off stock losses on your taxes? YouTube Can You Write Off Uniforms On Taxes Web the irs only allows you to deduct the cost of work clothing and uniforms if you satisfy a number of. Web eligible pieces of clothing can be claimed alongside your other deductible expenses, on schedule c of your tax. Web work clothes are tax deductible if your employer requires you to wear them everyday but they cannot be worn. Can You Write Off Uniforms On Taxes.

From www.covenantwealthadvisors.com

What Medical Expenses Can You Write Off On Your Taxes This Year? Can You Write Off Uniforms On Taxes Web clothing is one of the more contested tax deductions, and it tends to get rejected a lot. Web eligible pieces of clothing can be claimed alongside your other deductible expenses, on schedule c of your tax. Web work clothes are tax deductible if your employer requires you to wear them everyday but they cannot be worn as. The option. Can You Write Off Uniforms On Taxes.

From fabalabse.com

What can a homeowner write off on taxes? Leia aqui What expenses can Can You Write Off Uniforms On Taxes Web work clothes are a miscellaneous tax deduction. The option to write them off as a miscellaneous deduction, subject to a 2% of adjusted gross income threshold, was discontinued in 2018 through the tax cuts and jobs act of 2017 (tcja). Web the irs only allows you to deduct the cost of work clothing and uniforms if you satisfy a. Can You Write Off Uniforms On Taxes.